SWIFT Security Assessment

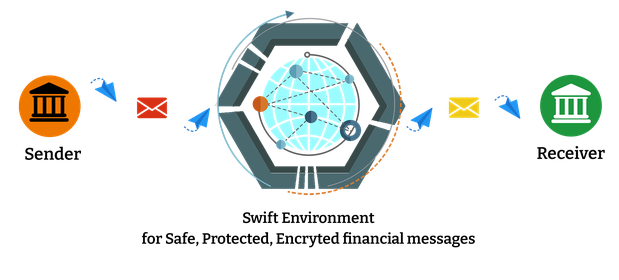

SWIFT, or the Society for Worldwide Inter bank Financial Telecommunication, is a global financial messaging network that facilitates secure communication and transfer of funds between banks and financial institutions. With more than 11,000 financial institutions across 200 countries connected to SWIFT, the network handles trillions of dollars in transactions every day.

Given the volume and value of transactions processed through SWIFT, ensuring the security of the network and its participants is of paramount importance. To this end, SWIFT has implemented a robust security framework that includes regular security assessments.

So, what is a SWIFT security assessment, and what role does it play in money transactions?

what role does it play in money transactions?

A SWIFT security assessment is an independent evaluation of a financial institution's security controls and processes related to its SWIFT infrastructure. The assessment is conducted by a SWIFT-appointed security auditor, who assesses the institution's compliance with the SWIFT Customer Security Programme (CSP).

The SWIFT CSP is a set of mandatory security controls that financial institutions must implement to protect their SWIFT infrastructure from cyber threats. The CSP includes controls related to access control, system hardening, network security, and fraud detection.

The role of a SWIFT security assessment is to ensure that financial institutions are complying with the CSP and have implemented adequate security controls to protect their SWIFT infrastructure. The assessment also identifies any vulnerabilities or weaknesses in a financial institution's security controls and provides recommendations for improvement.

Financial institutions that fail to comply with the CSP or do not implement adequate security controls may be deemed non-compliant by SWIFT. Non-compliance can result in penalties, including the suspension or termination of a financial institution's access to the SWIFT network.

In addition to ensuring the security of the SWIFT network, a SWIFT security assessment also plays a crucial role in money transactions. By ensuring that financial institutions have implemented adequate security controls, the assessment helps to prevent fraudulent transactions and unauthorized access to the SWIFT network.

The assessment also helps to build trust between financial institutions by providing assurance that their counterparts have implemented adequate security controls to protect their SWIFT infrastructure. This trust is essential in facilitating secure money transactions between financial institutions across the globe.

In conclusion, SWIFT security assessments play a critical role in ensuring the security of the SWIFT network and facilitating secure money transactions between financial institutions. By implementing the mandatory security controls outlined in the CSP and undergoing regular security assessments, financial institutions can help to prevent fraudulent transactions and maintain the trust necessary for secure financial transactions.